Kumpulan Contoh Surat Akuan Bujang Daripada Majikan yang Baik dan Benar 2019. Citation and commencement 1.

Commercial Title Hda Status Can Mot Be Exempted

A 2162020 and Stamp Duty Exemption No4 Order 2020 PU.

Surat akuan stamp duty exemption no 3 order 2019. 1 This order may be cited as the Stamp Duty Remission Order 2019. 1 This order may be cited as the Stamp Duty Remission Order 2016. Suatu perintah tahanan pengawasan kediaman terhad buang negeri atau depotasi.

IN exercise of the powers conferred by subsection 80 2 of the Stamp Act 1949 Act 378 the Minister makes the following order. I bought and signed in early 2019 under Stamp Duty Exemption No. 1 This order may be cited as the Stamp Duty Exemption No.

Stamp Duty chargeable at 3 after RM1 Million to RM25 Million Certification HOC 20202021 by relevant bodies is to be submitted to Inland Revenue Board for the purpose to obtain. A542021 - Akuan Berkanun Perjanjian Pinjaman pdf PUA532021 - Akuan Berkanun Pindah Milik pdf PUA492019 - Akuan Berkanun Pindah Milik pdf Surat Akuan Seksyen 15A Akta Setem 1949 pdf Surat Akuan Seksyen 15 Akta Setem 1949 pdf PUA3782018 - Akuan Berkanun Pindah Milik pdf PUA3772018 - Akuan Berkanun Pindah Milik pdf PUA321. Anyhow wed suggest you submit the Stamp Duty exemption request to LHDN and its up to LHDN to approve or reject your application.

A 3022021 dated 12 July 2021 stamp duty exemptions are given for residential properties which are sold during the period between 1. STAMP DUTY EXEMPTION NO. Stamp Duty Exemption No7 Order 2018 This Order exempts from stamp duty any instrument of transfer executed in relation to the purchase of one unit of residential property having a market value exceeding RM30000000 but is not more than RM100000000 by an individual subject to the following conditions being fulfilled.

1 Subject to subparagraphs 2 3 and 4 all instrument of transfer for. Citation and commencement 1. 2 2014 pua 3612014 akta setem 1949 bagi surat cara pindah milik harta tanah pembelian harta kediaman berharga tidak melebihi rm500000 pada atau selepas 01012015 tetapi tidak lewat daripada 31122016.

Akuan berkanun dibuat berhubung permohonan peremitan duti setem perintah duti setem peremitan no. 1 This order may be cited as the Stamp Duty Exemption No. A 377 4 STAMP ACT 1949 STAMP DUTY EXEMPTION NO.

1 This order may be cited as the Stamp Duty Exemption Order 2021. Citation and commencement 1. 1 Any loan agreement to finance the purchase of only one unit of residential.

2 This Order is deemed to have come into operation on 8 September 2007. Surat Akuan Sumpah PU. IN exercise of the powers conferred by subsection 801 of the Stamp Act 1949 Act 378 the Minister makes the following order.

Citation and commencement 1. Stamp Act 1949 Act 378 the Minister makes the following order. Citation and commencement 1.

2 This Order comes into operation on 1 January 2019. 1 Stamp Duty Remission Order 2018 PU. Stamp Act 1949 Act 378 the Minister makes the following order.

2 This Order is deemed to have come into operation on 1 January 2019. A 320 which will come into operation. 1 This order may be cited as the Stamp Duty Exemption No.

The Stamp Duty RemissionNo2 Order 2019 is a piece of subsidiary legislation enacted on 20 December 2019. 1 This order may be cited as the Stamp Duty Remission Order 2018. 2 This Order comes into operation on 1 January 2017.

It came into effect last year on. Stamp Duty Exemption No4 Order 2020 The exemption of stamp duty with effective on 1 June 2020 for the residential property price between RM300000 to RM25Million. 7 Order 2018 first time homebuyer can get stamp duty exemption for buying residential property of value from rm300000 to rm1000000.

1 The Minister exempts all instrument of transfer for the purchase. Year 2020 Stamp Duty Order Exemption PU. Stamp Act 1949 Act 378 the Minister makes the following order.

3 ORDER 2019 AMENDMENT ORDER 2019 IN exercise of the powers conferred by subsection 801 of the Stamp Act 1949 Act 378 the Minister makes the following order. Of the Stamp Act 1949 Act 378 the Minister makes the following order. 1 This order may be cited as the Stamp Duty Exemption No.

If the SPA stamped in 2019 then 2019 ruling apply. 2 This Order is deemed to have come into operation on 1 January 2021. 1 This order may be cited as the Stamp Duty Exemption No.

2 This Order is deemed to have come into operation on 1 January 2019. 2 This Order is deemed to have come into operation on 1 June 2020. 3 Order 2019 Amendment Order 2019.

6 ORDER 2018 I N exercise of the powers conferred by subsection 801 of the Stamp Act 1949 Act 378 the Minister makes the following order. Stamp Duty Order Exemption - Year 2020. 2 This Order comes into operation on 1 July 2019.

Citation and commencement 1. 3 tidak pernah dibuat atau berkuatkuasa terhadap saya. Citation and commencement 1.

The exemption on the instrument of transfer is limited to the first RM1Million of the property price and the stamp duty will be charged RM3 for every RM100 of the balance property. IN exercise of the powers conferred by subsection 801 of the Stamp Act 1949 Act 378 the Minister makes the following order. A 3012021 and Stamp Duty Exemption No5 Order 2021 PU.

Circular No 0012019 Dated 3 Jan 2019 To Members of the Malaysian Bar Orders Relating to Stamp Duty Exemption and Remission and Real Property Gains Tax Exemption Please take note of the following orders which came into operation on 1 Jan 2019 unless otherwise indicated below. 1 Subject to subparagraph 2 the amount of duty stamp chargeable on any. Dikenakan terhadap saya apa-apa bentuk sekatan atau pengawasan sama ada dengan bon atau sebaliknya di bawah mana-mana yang berhubungan undang-undang keselamatan.

A 2172020 dated 28 July 2020 or Stamp Duty Exemption No4 Order 2021 PU. Pengecualian duti setem yang boleh dikenakan ke atas semua surat cara pindah milik harta tanah berhubung pembelian satu unit harta kediaman pertama bernilai tidak melebihi RM30000000. Application of Stamp Duty Exemption - Transfer Full Exemption of stamp duty for transfer of property priced between RM300000 to RM1 Million.

If the SPA stamped in the year 2018 then 2018 stamp duty ruling applies. This order may be cited as the Stamp Duty Exemption No. 1 An amount according to the value of residential property as specified in the.

Contoh Surat Akuan Bujang Daripada Majikan have an image from the otherContoh Surat Akuan Bujang Daripada Majikan In addition it will include a picture of a kind that might be observed in the gallery of Contoh Surat Akuan Bujang Daripada Majikan. 2 This Order comes into operation on 1 July 2019. 1 This order may be cited as the Stamp Duty Remission Order 2008.

1 An amount of one thousand and five hundred ringgit RM150000 shall be remitted from the stamp duty chargeable on any loan agreement to finance. So you have to check your SPA.

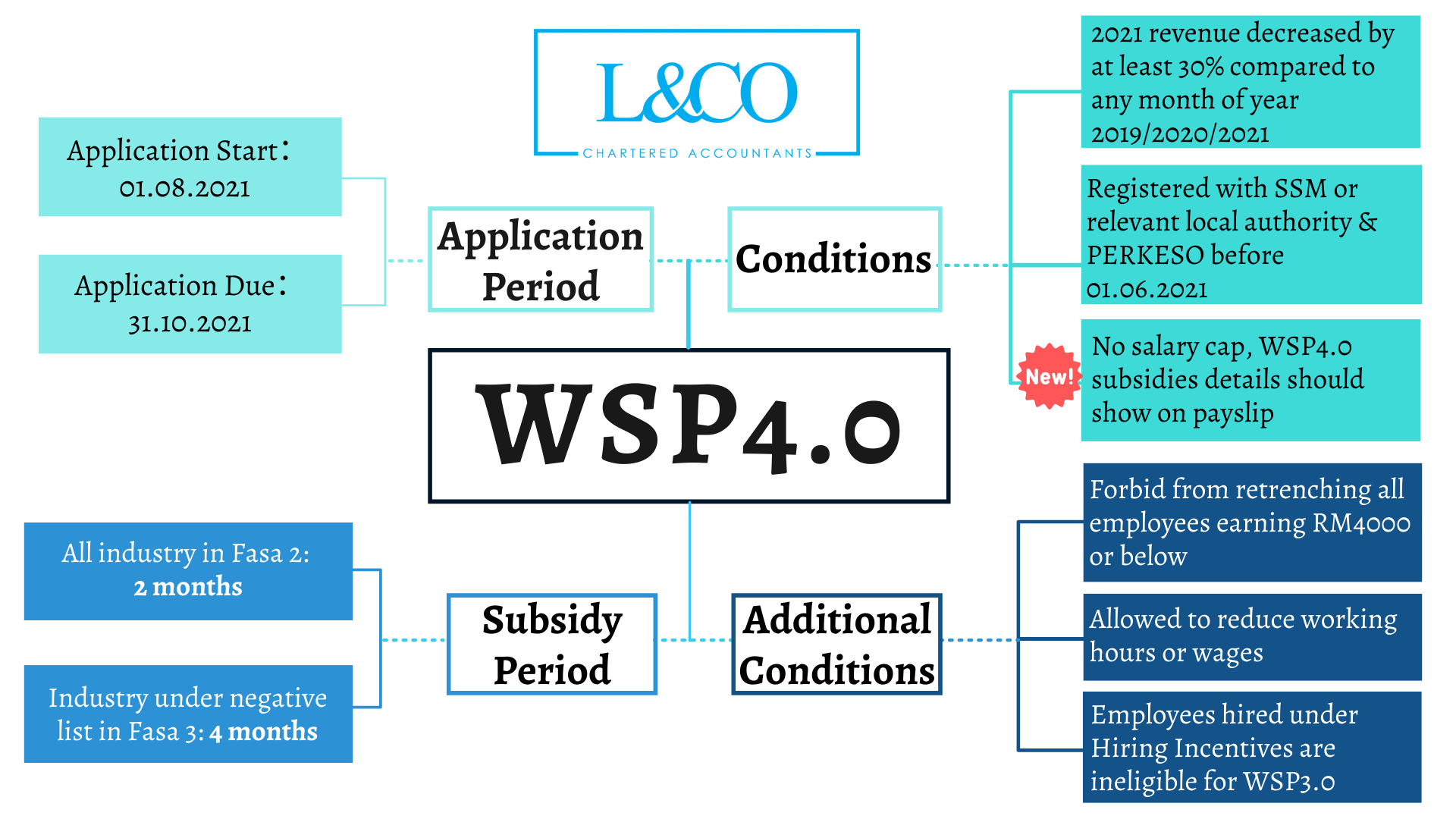

Wage Subsidy Program 4 0 Wsp4 0 Psu4 0 L Co

No comments